Washington, DC — The ‘Prosper Africa’ policy launched by the Trump administration last yearto substantially increase U.S. investments in Africa (which pale relative to those from China, India and France) could get a boost by fostering access to international capital markets for African governments, as the George W. Bush administration did nearly two decades ago.

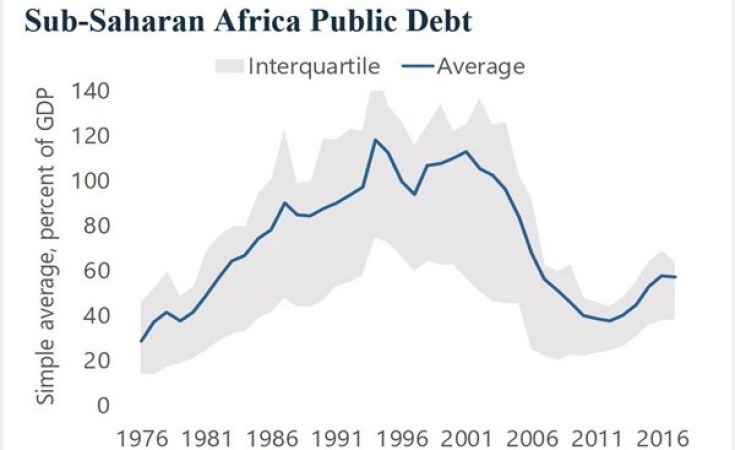

African sovereign debt just surpassed $100 billion in 2019 - the most recent being a $3 billion issue of Angolan bonds. This is remarkable considering that African governments had virtually no capital markets access a decade ago when few had credit ratings and international investors had little interest in buying their bonds.

Since then, a score of African governments, most of them rated in the single B or BB categories, have tapped high yield Eurobond markets. Yield‐hungry international investors from the United States., Europe and Asia have eagerly bought these Eurobonds, with demand substantially outstripping supply.

While most African governments’ Eurobonds have funded sound capital investments, some have instead financed domestic consumption, with rather sorry results for both the borrowing governments and the investors.

Côte d’Ivoire has set a good example of how to borrow for productive purposes. The country was disrupted by a six‐month civil war in 2011 when Alassane Outtara became president of the country. The country’s GDP contracted 4.2% that year, but post‐conflict GDP growth averaged 8.9% between 2012 and 2017 and is projected to grow at 8% in the medium term, higher than the average for sub-Saharan Africa.

Côte d’Ivoire has borrowed for productive purposes, Zambia to fund domestic consumption

The country has a relatively low debt to GDP ratio of 48.6%, roughly equally split between external borrowings and domestic debt. Côte d’Ivoire’s fiscal deficit was 4.5% in 2017 and is on track to fall to 3% this year. The country borrows solely to finance capital spending, making its Eurobonds (rated Ba3 by Moody’s and B+ by Fitch) good investments for international investors.

By contrast, copper‐rich Zambia has borrowed largely to fund domestic consumption. Its development strategy was based on rapidly rising infrastructure spending. Fiscal revenues fell with copper prices (an inherent risk for a commodity exporting country that demands better preparation) and deficits rose to a huge 10% of GDP in 2018, financed by both Eurobonds and domestic debt.

Total debt exceeds 70% of GDP, much of it being used for current spending. The kwacha – the local currency – has rapidly depreciated and domestic interest costs have soared. Zambia’s Eurobonds due in September 2020 have dropped in price to as low as 60‐65 cents on the dollar.

Moody’s Investor Service projects that Zambia will face refinancing risks on Eurobond maturities of $750 million in 2022 and on a further $2.25 billion over the subsequent five years. The country’s sovereign ratings have fallen during the last few months to CCC+ from S&P, Caa2 from Moody’s and CCC from Fitch, the latter two ratings having negative outlooks.

Consequently, Zambia is effectively shut out of the international capital markets, with little choice but to squeeze government spending. The IMF has recommended that Zambia incur no new commercial borrowings, increase government revenues and spend only on well‐targeted public investments that it can afford.

Twenty years ago, virtually no African country could borrow in the international capital markets. To pave the way for their Eurobond market access, the U.S. State Department under Secretary Colin Powell and Assistant Secretary Walter Kansteiner promoted African sovereign credit ratings. The U.S. government offered to pay for African governments to get a Fitch rating, and the UNDP offered to pay for an S&P rating.

As a result, 29 African governments have been rated by Fitch, S&P and Moody’s. The borrowing countries include Ghana, Senegal, Nigeria, South Africa, Kenya, and Rwanda in addition to Cote d’Ivoire and Zambia. Many African banks and non‐banks ‐ such as Access Bank and Dangote from Nigeria – have followed suit with international ratings. This trend has fostered African growth and provided investors with attractive returns.

External borrow for productive purposes can accelerate growth and per capita incomes.

There are four key lessons here.

First , African governments should know that borrowing to consume is a recipe for eventual loss of capital market access. According to Moody’s, “Zambia's first two Eurobonds (issued in 2012 and 2015) were accompanied by a detailed plan on how the proceeds would be spent” but “the third Eurobond left greater room for resources to be diverted to government consumption.”

Second , while Polonius advised to “neither a borrower nor a lender be”, external borrowings for productive purposes can help accelerate growth and per capita incomes. For example, Uganda is rated B2 by Moody’s, B by S&P and B+ by Fitch but has thus far shunned the Eurobond markets. It could borrow for faster GDP and per capital income growth to invest in infrastructure, with governance structures that ensure that the funds raised are used productively, as in Côte d’Ivoire.

Third , investors seeking high yields on African sovereign debt should not only look at the credit ratings on these bonds and the high yields they offer but also determine if the money they provide is likely to be used by the borrowing government for productive purposes. Failing that, investors likely will face problems recouping their money.

Finally , if ‘Prosper Africa’ chooses to leverage the power of financial guarantees and insurance (e.g., from U.S. EXIM Bank, Development Finance Corporation, World Bank, MIGA and the private sector), it can accelerate African capital market access. African borrowers could raise several hundred billion dollars in Eurobonds over the next decade, with a portion rated investment grade. Such capital market access, responsibly used for productive investments, could lead to faster growth and development of Africa.

Mahesh Kotecha, who was born in Uganda and is a naturalized U.S. citizen, is president of Structured Credit International, an international financial advisory firm that advises African supranationals, banks and governments. Kotecha is a member of the Bretton Woods Committee, International Advisory Panel of the East African Development Bank, Chatham House and the Council on Foreign Relations, where he directed a Roundtable on Capital Flows to Africa, which recommended in 2002 that African governments seek sovereign ratings to reduce perceptions of risk and to attract capital