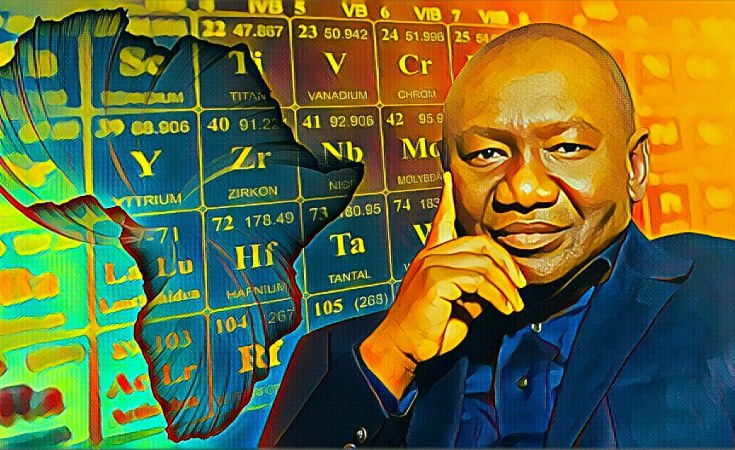

Pan-African critical minerals magnate and the continent's "Green Czar," Benedict Peters is working to secure essential U.S. and European supply chains

Africa palpitates with geopolitical intrigue. Despite the rampant poverty associated with the continent, Africa sits at the heart of the global economy, its resources pumping nutrients into the arteries of the international monetary system. The world's powers are aware that any disruption to their supply could put the global economy into cardiac arrest.

But its coveted wealth leads to instability, as forces from all directions push and pull for influence over them. With this eighth military coup since 2020, Africa is the central stage for global geopolitical drama, a frenzied tug of war over Africa's abundant resource wealth between the United States, China, and Russia. As economies look toward green transitions, new resources are rising in importance to challenge the previous dominance of hydrocarbons. On the frontlines of this Green Revolution, one man has emerged as Africa's new resource czar.

Benedict Peters is a pan-African mining and hydrocarbons magnate, whose net worth has been estimated at anything from $3 billion to $7 billion. His diversified portfolio spans the oil and mining industries across Ghana, Nigeria, Zimbabwe, the Democratic Republic of Congo, Zambia, Tanzania, Mozambique, Cote d'Ivoire, Sierra Leone, Guinea Bissau, Namibia, Libya, South Africa, and Switzerland.

Despite his lower public profile, Peters began with Nigeria's principal export, oil, entering the oil and gas industry in the early 1990s and joining Ocean and Oil Limited (now Oando) and MRS Oil Nigeria Plc, where he served as managing director. In 1999, he founded Sigmund Cummunecci, which later evolved into Aiteo, a global supplier of refined oil and gas products, and eventually built Aiteo into Africa's leading independent indigenous oil producer.

However, the Green Revolution has seen him diversify his palette away from the dense hues of black gold. With his company, Bravura, he ventured into the vibrant spectrum of critical minerals, betting on resources that many were overlooking. With Bravura as his brush, he has painted bold strokes across the untapped canvas of Africa, investing in the rich colors of uranium's deep yellows, platinum's metallic sheen, lithium's soft greys, steel's glossy silver, copper's warm glow, and gold's radiant luster.

Under his visionary guidance, Bravura is now at the forefront, blending the diverse shades of these resources to create a masterpiece of sustainable investment across the continent. Peters' focus is not solely on the extraction of these minerals but also on shaping the continent's broader critical minerals agenda.

"Benedict Peters' strategic pivot toward critical minerals marks a significant shift in the trajectory of Africa's resource management," said Omokolade Ajayi, a financial analyst who monitors the performance of African companies and the fortunes of the continent's billionaires. "His foresight in recognizing the untapped potential of these minerals could redefine Africa's position in the global economy, making it an indispensable partner in the green revolution."

In a groundbreaking partnership, Peters' Aiteo, Africa's largest integrated energy company, has joined forces with The Atlantic Council's Africa Center to launch a three-year program focusing on the continent's critical minerals. This initiative is poised to position Africa as an indispensable player in EU and U.S. supply chains of the 21st century, particularly for technologies such as electric vehicles and lithium batteries.

"The partnership between Peters' Aiteo and The Atlantic Council is not just a strategic alignment but a visionary step toward securing a sustainable future for global energy resources," Ajayi added. "By focusing on critical minerals, this initiative is poised to establish new paradigms in how we approach energy transition and resource security, signaling a significant leap towards a greener, more sustainable future."

The program's kick-off includes the creation of a dedicated task force that convened during Mining Indaba, Africa's premier mining event, highlighting Peters' strategic approach to resource management. This task force, with representatives from the financial sector, development agencies, and governments across three continents, reflects the multinational, Western-led interest in Africa's mineral wealth. Supported by Aiteo, this initiative is set to spotlight the continent's rising demand for resources, the importance of local value chains, and the potential for job and value creation within the industry.

As another layer to his ever-growing investment canvas, Peters added a platinum mining venture in Zimbabwe, acquiring a 3,000-hectare concession near Harare. However, setbacks arose due to regulatory issues under President Emmerson Mnangagwa. Peters remains committed to resolving concerns while exploring new investments, including a lithium deposit in Kamativi, Zimbabwe. Bravura Holdings also holds concessions for cobalt mining in the Democratic Republic of Congo, copper mining in Zambia, gold mining in Ghana, and uranium mining in several countries across the continent.

By positioning his company at the forefront of the electric vehicle revolution, Peters aims to supply the essential raw materials that will drive millions of sustainable transport vehicles in the future. Demand for metals like cobalt, nickel, copper, and aluminum will grow significantly by 2030. Cobalt demand is expected to increase by 1.5 times, nickel demand may rise five-fold, and copper and aluminum demand could grow six-fold. The early bird catches the worm, and Peters' foresight in regards to the electric vehicle industry could pay massive dividends in the future.

Africa's significance in the global landscape of critical minerals is undeniable, holding approximately 30 percent of the world's mineral reserves, crucial for renewable and low-carbon technologies like solar power, electric vehicles, and battery storage.

Countries like Tanzania have signed multimillion-dollar contracts with Australian firms and a $500-million trade deal with the United States focusing on extracting and processing critical minerals to reap the coming windfall of the Green Revolution. High-profile collaborations, such as the partnership with Barrick Gold Corporation and a supply agreement with Tesla for Anode Active Material (AAM), underscore Tanzania's and Africa's strategic position in the global mining industry.

Everyone is eyeing Africa's resource pie hungrily, vying to carve out their own slices to be devoured. This culinary contest is global, and critical minerals serve as the most sought-after ingredients, with superpowers such as China, the United States, and Russia jostling at the table for the choicest cuts of rare earth elements, lithium, cobalt, bauxite, chromium, copper, iron, lithium, manganese, platinum, uranium, and nickel, key flavors in the Green Revolution recipe. Each slice of Africa's resource pie contains the necessary nutrients for global dominance.

In this context, Peters' collaboration with The Atlantic Council stands out for its focus on fortifying the supply chain of critical minerals, essential for the economic and geopolitical interests of the U.S. and EU.

Echoing this sentiment, industry titans Bill Gates and Jeff Bezos have backed KoBold Metals, a California-based exploration company that recently struck a rich vein of copper in Zambia, showcasing the immense global interest in Africa's critical minerals. Their venture underscores the continent's lure as a treasure trove for essential components in the burgeoning battery technology sector and other industrial applications.

Similarly, Elon Musk's ventures, particularly through Tesla's quest for sustainable energy solutions, cast a spotlight on the critical need for lithium, cobalt, and nickel — minerals abundant in Africa. Musk's keen interest in securing sustainable sources for these metals positions Africa as a pivotal player in the electric vehicle revolution, further attracting global attention to the continent's mineral riches.

China wants a seat at the table of this grand geopolitical banquet. The biggest economic challenge to the West is increasing its economic clout in Africa, primarily through the One Belt One Road project. The Belt and Road Initiative (BRI) also raises concerns about debt sustainability and security implications, highlighting the need for African countries to ensure transparency, accountability, and mutual benefit in their engagements with China.

China is Africa's largest bilateral creditor and has provided $143 billion in loans since 2000, with a notable increase in recent years. It committed an additional $60 billion in development financing at the 2018 Forum for China–Africa Cooperation.

China's financing model in Africa, characterized by grants, aid, and low-interest loans without strict Western conditions, alongside its non-selective engagement with all types of governments under the BRI, has positioned it as a preferred partner for 52 African countries. Yet, this model faces criticism for elevating debt levels and prompting accusations of "debt-trap" diplomacy, where unable-to-repay nations may cede significant infrastructure, such as ports, to China.

Likewise, China's approach to Africa's rare earth bonanza has been criticized as predatory by many African states. Nigeria recently suspended illegal titanium mining operations run by Ruitaiin the country and Namibia canceled a Chinese mining company's (Xinfeng) license for exploring lithium after it appeared their license had been fraudulently obtained.

Russia has been perhaps the most proactive challenger to the Western presence in Africa. Though its Wagner group is officially defunct, with its former leader, businessman Evgeny Prigozhin, dead after an "air accident," Russian mercenaries and intelligence officers operate in the continent. It is speculated that Russian intelligence may have been behind many of the recent coups in the Sahel, which have seen countries like Mali and Burkina Faso exit the Western sphere of influence, leaving ECOWAS and ejecting French forces from their countries.

Wagner was also operating a number of lucrative resource extraction schemes throughout Africa, such as the illegal deforestation of redwood trees for timber and was involved in a number of mining projects, particularly in the Central African Republic (CAR).

CAR specialist Anjan Sundaram's investigations have revealed a number of operations involving Wagner shell companies in the republic. Wagner Group's subsidiary, Lobaye Invest, has commandeered gold and diamond mining operations across several regions. The activities of Wagner and its affiliates are reported to amass roughly $1 billion annually from such mining endeavors.

Under an arrangement with the CAR government, the revenues generated from mining directly finance Wagner's mercenary activities. This pact also grants Wagner tax exemption on extracting natural resources, imposing the environmental and societal repercussions of their mining operations on the CAR's populace without financial recompense.

Diamville, another Wagner affiliate, is involved in the transnational movement of gold and diamonds from the CAR, primarily to destinations in the Middle East. These resources are then liquidated and presumably subsumed by and funneled into the Russian Ministry of Defense.

In the new scramble for Africa, essential for the Green Revolution, Peters stands out as a pivotal figure bridging the West and the Global South. His endeavors align with Western efforts to diversify supply chains and diminish reliance on rivals, offering an alternative to China's dominance in rare earth elements. Through initiatives like the Energy Resource Governance Initiative and his newly announced program with The Atlantic Council, Peters is not only securing alternative sources for critical minerals but also establishing himself as a discreet yet influential architect in global policy and market dynamics, becoming the green czar of Africa's resource-rich landscape.