Addis Ababa — In its continuing efforts to advocate the urgency of stemming illicit financial flows from Africa, the Economic Commission for Africa (ECA) and its partners will next week host a workshop in Nairobi, Kenya, to, among other things, establish a clear work plan and deliverable actions for the core group and Consortium of Stakeholders working to confront the challenge of reducing outflows from the continent.

The workshop, which will run from 21-22 November, also seeks to review and endorse the draft terms of reference of the Consortium.

Acting Executive Secretary of the ECA, Mr. Abdalla Hamdok, says the meeting is important, as it builds on previous consultations where stakeholder underlined that there is limited capacity at national, sub-regional and continental levels for tackling IFFs. As such, attention is needed in the areas of building capacity and sharpening existing tools to implement the High Level Panel recommendations.

"Ultimately, stakeholders are in agreement on the need to scale-up efforts to ensure Africa does not continue to lose billions of dollars that could be funding its own growth and development," stresses Mr. Hamdok.

The workshop will bring together representatives from the African Union Commission (AUC), the ECA, the African Development Bank (AfDB), the Thabo Mbeki Foundation, Open Society Foundation and the Tax Justice Network among others.

Note to Editors:

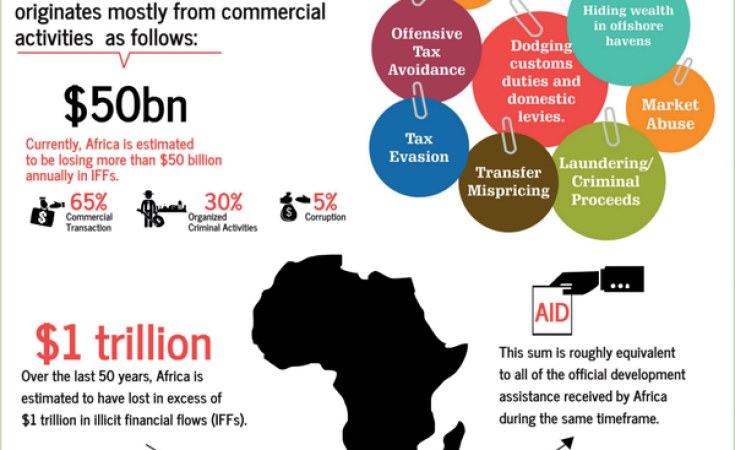

Illicit financial flows out of Africa have become a matter of major concern because of the scale and negative impact of such flows on Africa's development and governance agenda. By some estimates, illicit flows from Africa could be as much as US $50 billion per annum. This is approximately double the official development assistance (ODA) that Africa receives and, indeed, the estimate may well be short of reality as accurate data does not exist for all transactions and for all African countries.

Some of the effects of illicit financial outflows are the draining of foreign exchange reserves, reduced tax collection, cancelling out of investment inflows and a worsening of poverty. Such outflows which also undermine the rule of law, stifle trade and worsen macroeconomic conditions are facilitated by some 60 international tax havens and secrecy jurisdictions that enable the creating and operating of millions of disguised corporations, shell companies, anonymous trust accounts, and fake charitable foundations. Other techniques used include money laundering and transfer pricing.