The African Development Bank is supporting Egypt's efforts to tap the Panda bond market to advance the renewable energy and sustainable water management sectors among others

The Board of Directors of the African Development Bank Group has approved a Partial Credit Guarantee of $345 million equivalent in Renminbi to Egypt to increase access to the Panda bond market to finance green and social projects.

The Bank Group's partial credit guarantee will allow Egypt to raise the equivalent of $500 million in the Panda Bond market, which are bonds denominated in Chinese yuan issued by foreign borrowers.

Bond proceeds will be used for clean transportation; renewable energy; energy efficiency; sustainable water and wastewater management; financing for MSMEs, and essential health services initiatives, among others. These sectors are prioritized under Egypt's Sovereign Sustainable Financing Framework (SSFF).

Dr Rania A. Al-Mashat, Egypt's Minister of International Cooperation, said, "Egypt's new agreement with the African Development Bank provides an additional dimension to the strategic partnership, which is focused on promoting the transition towards renewable energy and financing sustainable infrastructure projects. Issuing international bonds in an untapped new market, backed by the African Development Bank, helps diversify financing sources and builds on previous efforts, including the green bonds launched in 2020."

Egypt's Minister of Finance, Dr. Mohamed Maait, said: " I would like to express the appreciation of the Egyptian authorities to the African Development Bank for their unwavering and continued support to the Egyptian economy, which reflects a deep confidence in the strength of our economic performance and proves the outstanding and deep-rooted cooperation history between Egypt and the African Development Bank. I believe that this step, leading to the issuance of a Sustainable Panda bond in the Chinese financial market, paves the way to explore new avenues to meet our strategic goals by entering new markets and widening our investor horizon, as well as achieving Egypt's vision 2030 targets." He added, "I seize this opportunity to recall the significant role of the regional and multilateral development banks to finance the development needs of the developing countries, in particular in the African continent, and to facilitate the penetration of the middle- and low-income countries to the financial markets at affordable rates. A task that we urge all our partners to consider expanding and easing its terms."

Mohamed El Azizi, African Development Bank Director General for North Africa, described the approval as historic. "Egypt will be the first African country to issue a Panda bond and, as the African Development Bank, it is our pleasure to provide support to Egypt to enable them to access the market. This partial credit guarantee will enable Egypt to enhance its credit rating and catalyze financing from international investors on competitive terms and pricing," El Azizi said.

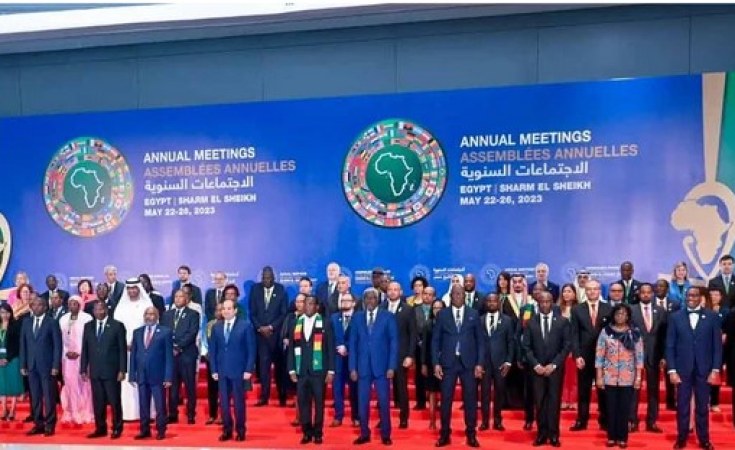

Egypt has been active in the sustainable and green bond markets since 2020 when it issued the MENA region's first green bond. In 2022, ahead of the COP-27 conference which was held in the Red Sea resort of Sharm El Sheikh, the Egyptian ministry of finance launched the country's SSFF to further underline its support and commitment to use various instruments for the financing of green projects. Beyond green bond issuances these instruments include sustainable, social, blue, sukuk and others debt instruments. The framework sets out procedures and rules for resource use, project selection, monitoring, and evaluation in line with international best practices.

"The Bank's support will play a counter-cyclical role in supporting Egypt in this transaction, especially during these periods of international investor aversion for African capital markets debts," said Ahmed Attout, African Development Bank acting director for Financial Sector Development. "A successful Panda bond issuance by Egypt through the Bank's PCG will pave the way for other regional member countries looking to diversify their funding sources and tap into international debt capital market," Attout added.

The project will promote inclusive growth and advance Egypt's green and social objectives. The sectors set out under the Sovereign Sustainable Financing Framework align closely with the bank's country strategy for Egypt as well as its High-5 operational priorities.

Contact:

Media Contact :

Communications and External Relations, [email protected]

Technical Contacts:

Hachem RAJHI, Senior Investment Officer, Financial Sector Development Department

Albin KAKOU, Principal Investment Officer, Financial Sector Development Department

Akane ZOUKPO SANANKOUA, Chief Investment Officer, Financial Sector Development Department