The world faces a global "polycrisis" affecting human and economic development at an unprecedented scale. Progress towards the Sustainable Development Goals (SDGs) has been painfully slow. For many countries, that progress has stalled or reversed, while the climate emergency is felt in intensifying force around the globe, hitting the most vulnerable the hardest. A much scaled up global effort is thus required to eradicate poverty, accelerate inclusive socioeconomic development, and tackle transboundary challenges.

At a time of increasing debt levels and strained government budgets, when more development finance is urgently needed, we, Heads of Multilateral Development Banks (MDBs), recognize the collective role we need to play in response to the global challenges and the efforts that will put us on track towards achieving the SDGs. To this end, we are committed to strengthen our collaboration and individual actions for greater impact. We will also continue to explore ways to expand our lending capacity. We have identified Capital Adequacy Frameworks (CAF) measures, including those under implementation and consideration which, with strong contributions from shareholders and development partners, could potentially yield additional lending headroom in the order of USD 300-400 billion over the next decade. MDBs, working in collaboration with other development partners, can offer substantial leverage, deep knowledge and expertise, and an unparalleled proximity to governments and those most in need.

In their recent New Delhi Declaration, G20 Leaders noted that the 21st century requires an international development finance system that is fit for purpose, putting MDBs at the center of solutions to global challenges. They endorsed the need for "better, bigger and more effective MDBs." We welcome the deliberations of the G20 Independent Expert Group in support of this ambitious agenda, as presented in Volumes 1 and 2 of its report, and the discussions with our shareholders.

We take this vote of confidence with high responsibility, stepping up our individual and collective actions. To rise to the challenge, we reiterate our commitment to make critical reforms to strengthen our financing capacity, to increase the speed and agility of our operations, and to improve the way we work together to maximize our impact as a system.

As we conclude our discussions in Marrakech, we agree to strengthen our collaboration in the following five critical areas:

Scaling up financing capacity. We will continue to explore financial innovations to further stretch our balance sheets, such as portfolio guarantees, hybrid capital and channelling of Special Drawing Rights through MDBs, in the context of our individual governance frameworks, while safeguarding our long-term financial sustainability, robust credit ratings, and preferred creditor status. We remain committed to continue exploring and sharing practices among MDBs. We will enhance and elevate our dialogue with credit rating agencies, to discuss methodological changes that could help achieve the joint goals of MDBs and stakeholders.

Boosting joint action on climate. We will continue our collaboration in the implementation of our joint approach to align our financing flows with the goals of the Paris Agreement on Climate Change. We are working to enhance our approaches to tracking and reporting climate outcomes, while continuing to jointly report our climate finance commitments. As we set ourselves for a successful COP28, we will pursue the launch of several activities and initiatives, including a joint MDB facility to support clients' Long-Term Strategies (LTS).

Enhancing country-level collaboration. To further improve our country-level coordination, we will promote our work around country-led programs, including country platforms, to ensure that our joint efforts are systemic, leveraging development partnerships, catalyzing private sector investment, and delivering greater impact. We will continue working with developing countries to strengthen their institutions and frameworks.

Strengthening co-financing. Recognizing our individual mandates and business models, we commit to strengthening our approach to co-financing among MDBs, including through harmonizing and mutually recognizing each other's policies and standards (starting with procurement), where appropriate, to the benefit of our clients.

Catalyzing private sector engagement. We will deepen our collaboration around joint innovative mechanisms for boosting private capital mobilization, both domestically and globally. We reaffirm the critical role MDBs must play in upstream engagement to build investment-enabling economic and regulatory environments, develop project pipelines, and provide early-stage investments. We recognize the need to explore further avenues for strengthening mobilization of private capital. We reiterate our commitment to delivering on the transformation of the Global Emerging Markets Risk Database (GEMs) and to releasing new and more comprehensive statistics in early 2024.

We will also continue with our strong partnership in other thematic areas to tackle global challenges and improve development outcomes. As we undertake this agenda, we stand ready to engage with our shareholders, clients, development partners, civil society, and other stakeholders to shape an MDB system that better responds to development challenges and delivers shared prosperity for those most in need. For that, we look forward to more intense engagement among our institutions, including at the Heads' level.

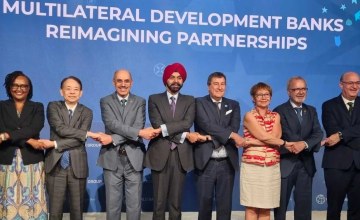

Statement by the Heads of the following MDBs:

African Development Bank

Asian Development Bank

Asian Infrastructure Investment Bank

Council of Europe Development Bank

European Bank for Reconstruction and Development

European Investment Bank

Inter-American Development Bank

Islamic Development Bank

New Development Bank

World Bank Group