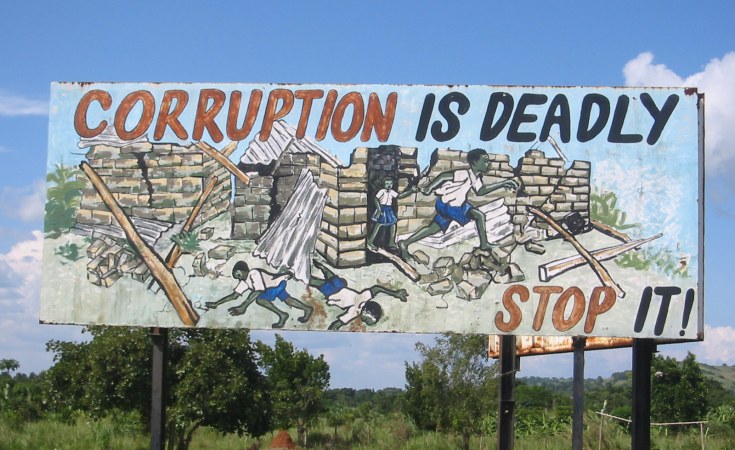

Corruption is a major obstacle to Uganda's development, impacting governance, economic stability, and the social structure. A severe consequence of widespread corruption is the rise in national debt. Corruption in Uganda has worsened the country's debt situation, emphasizing the ways corrupt practices damage economic health and impose burdens on future generations.

Misallocation and mismanagement of borrowed funds

In Uganda, corruption frequently manifests through the misallocation and mismanagement of borrowed and public funds. Government officials and influential individuals often embezzle funds intended for development projects, healthcare, education, and infrastructure.

For instance, the Global Fund for AIDS, Tuberculosis, and Malaria scandal revealed that millions of dollars intended for health programs were misappropriated by senior officials. Similarly, the Auditor General's reports have consistently highlighted cases of misused funds in various government departments. As a result, these projects are either left incomplete or are poorly executed, requiring additional funds to address the deficiencies. This ongoing cycle of financial misappropriation and mismanagement compels the government to seek more loans and grants to cover the resulting shortfalls, thereby increasing the Uganda's public debt.

Inflated contracts and ghost projects

Corruption greatly exacerbates Uganda's debt through inflated contracts and ghost projects. Public procurement processes are often manipulated, with contracts awarded to firms that provide kickbacks rather than those offering the best value. These contracts are typically overpriced, resulting in unnecessary expenditures. For instance, investigations by the Inspectorate of Government revealed several cases of inflated contract prices in road construction projects (IG Report, 2023). Ghost projects (fictitious initiatives that receive funding on paper but are never actually implemented) are other public resources divert practice. The 2023 Auditor General's Report revealed that over 10,000 government workers were illegally on the payroll. These corrupt practices create fiscal deficits, forcing the government to borrow more money to cover the gaps, thereby escalating the national debt.

Inefficiencies in revenue collection

Corruption undermines the efficiency of revenue collection in Uganda. Tax evasion is often facilitated by corrupt tax officials resulting to significant revenue loss. Additionally, the diversion of collected taxes in to private accounts rather than the public treasury further depletes government resources. For example, a recent investigation by the Uganda Revenue Authority uncovered a scheme where officials colluded with businesses to underreport earnings and avoid taxes. To compensate for these deficits, the government resorts to external borrowing, thereby increasing the national debt.

Erosion of public trust and investor confidence

Corruption erodes public trust in government institutions and diminishes investor confidence. When citizens perceive their government as corrupt, they are less likely to comply with tax regulations, further reducing state revenues. For instance, a 2023 survey by Transparency International reported that 70% of Ugandans believe corruption is widespread, contributing to significant tax evasion. Additionally, investors, concerned about the corrupt environment, may withdraw or withhold investments. Recent cases, such as the controversy surrounding the mismanagement of COVID-19 relief funds, have led to a noticeable decline in foreign direct investment. The World Bank's 2023 Report highlighted that investor confidence in Uganda has been negatively impacted by corruption scandals, resulting in reduced economic activity. This reduction in both domestic and foreign investments stunts economic growth, forcing the government to seek financial assistance from international lenders, thereby increasing the national debt.

International aid and loans as a double-edged sword

While international aid and loans are intended to support development, in a corrupt environment, these funds can become counterproductive. Corrupt officials may divert a significant portion of these funds, leaving projects underfunded and incomplete. Consequently, the intended economic benefits are not realized, and the loans still need to be repaid with interest. This not only increases the immediate debt burden but also hampers long-term economic growth, necessitating further borrowing.

Recommendations to address rising public debt due to corruption

Strengthen Anti-Corruption measures. Enhance the effectiveness and independence of anti-corruption agencies and ensure rigorous enforcement of anti-corruption laws to deter and address corrupt practices.

Improve Financial Transparency and Management. Implement robust financial management systems and increase transparency in public spending to prevent the misallocation and mismanagement of funds.

Reform Procurement Process. Overhaul procurement and contract management to eliminate manipulation and ensure value for money.

Modernize Revenue Collection Systems. Enhance tax collection systems and oversight to ensure all revenue is accurately collected and deposited in to the public treasury.

Promote Civic Engagement and Ethical Leadership. Foster public involvement in governance, encourage ethical behavior within public institutions, and build public trust through greater transparency and accountability in government operations.

By addressing these issues comprehensively, Uganda can mitigate the impact of corruption on national debt and pave the way for sustainable development.