-

Africa: There Is a Better Way to Avoid Tax Avoidance

African Arguments, 14 April 2022

Tax simplification would level the playing field between tax authorities and multinationals by relying on easily verifiable standards. Read more »

-

Africa: How Multinationals Avoid Taxes in Africa and What Should Change

The Conversation Africa, 5 April 2022

In developing countries, and the sub-Saharan region especially, the scale of unmet basic needs is enormous. It is estimated that 3 billion people in the developing world subsist on… Read more »

-

Kenya: Experts Welcome Kenya's Plan to Increase Digital Tax on Foreign Firms

Capital FM, 12 April 2022

The Government's plan to double the digital service tax on multinational companies from 1.5 percent to 3 percent has been lauded as a timely move by experts who said that it will… Read more »

-

Nigeria: IMF Warning - Experts Say Nigeria Not Exploring Tax Revenue Sources

Daily Trust, 11 April 2022

Experts have advised the federal government to explore alternative sources of revenue to reduce the country's debt burden. Read more »

-

Zimbabwe: Zimra Intensifies War Against Corruption

263Chat, 17 March 2022

The Zimbabwe Revenue Authority (ZIMRA) is engaging various stakeholders to map strategies to combat corruption relating to tax fraud which has come at a huge cost to the country's… Read more »

-

Africa: Africa's Problem With Tax Avoidance

DW, 19 April 2019

Every year African countries lose at least $50 million in taxes -- more than the amount of foreign development aid. So where is it all going and how can multinational companies be… Read more »

-

Africa: How Multinationals Avoid Paying Their Taxes

allAfrica, 16 January 2019

Two pioneering studies which expose in new detail how multinational corporations avoid paying tax in a developing nation are likely to intensify pressure on the largest firms… Read more »

There Is a Better Way to Avoid Tax Avoidance!

Tax simplification would level the playing field between tax authorities and multinationals by relying on easily verifiable standards, writes Tim Hirschel-Burns for African Arguments.

African governments can fight tax avoidance and level the playing field between their tax authorities and multinational corporations by adopting rules that reduce administrative burdens and rely on easily verifiable standards, according to a study by Yale Journal of International Law.

Tax dodging is used to describe all of the ways - tax avoidance, tax evasion, corruption, and offshore accounts - that companies and rich individuals employ to reduce their tax bills. They lobby governments for tax breaks and lower corporate tax rates, exploit obscure loopholes in tax laws or shift profits into tax havens.

Taxes enable the state to redistribute wealth to alleviate poverty. They also provide education, healthcare, social security, pensions, efficient public transport, clean water, and other public services taken for granted in developed economies.

But in both developed and developing countries, tax revenues are being undermined by the ability of some of the wealthiest taxpayers - including many transnational companies - to effectively opt-out of the corporate tax system. They do this through a combination of ingenious (and lawful) tax haven transactions, and huge tax concessions awarded by governments write Jia Liu and Olatunde Julius Otusanya for The Conversation.

InFocus

-

In developing countries, and the sub-Saharan region especially, the scale of unmet basic needs is enormous. It is estimated that Read more »

-

Nigeria's backward integration policy was introduced in 2002 and operated through tariffs, levies and tax breaks. Backward integration means that rather than buying from outside, ... Read more »

-

Zambia will now try to estimate how much revenue was lost under its tax treaty with Mauritius, which one official described as "not balanced or fair". It is the second African ... Read more »

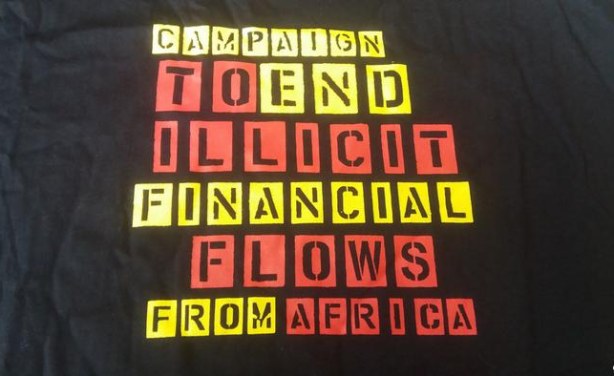

Stopping illicit international financial flows out of Africa has proved to be a complicated task.