-

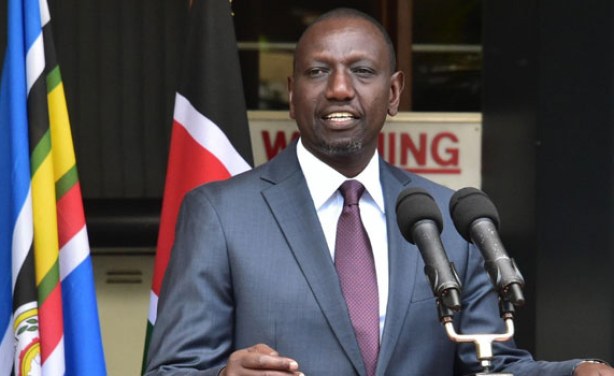

Kenya: 800,000 Hustler Fund Loan Borrowers Have Defaulted in Repayment, President Ruto Says

Capital FM, 3 February 2023

President William Ruto now says 800,000 Hustler Fund loan borrowers have defaulted in their payments. Read more »

-

Kenya: President Ruto Defends Legality of Hustler Fund

Capital FM, 5 January 2023

President William Ruto has defended the legality of the Sh50 billion Hustler Fund following widespread criticism that it is operating illegally. Read more »

-

Kenya: Hustler Fund Kitty Has So Far Disbursed Sh3.6 Billion

Capital FM, 5 December 2022

The Hustler Fund kitty has so far disbursed Sh3.6 billion according to latest released by Ministry of Cooperatives and Micro Small and Medium Enterprises. Read more »

-

Kenya: Sh2.9 Billion Borrowed So Far From Hustler Fund Kitty

Capital FM, 4 December 2022

A total of Sh2.9 billion has been borrowed by Kenyans from the hustler fund kitty as of Sunday. Read more »

-

Kenya: Sh1.8 Billion of Hustler Fund Kitty Disbursed So Far

Capital FM, 3 December 2022

The Hustler Fund kitty has so far disbursed Sh1.853 billion with the number of loans issued currently standing at 3,174,607. Read more »

-

Kenya: Kenyans to Access Hustlers Fund By Dialling *254#

Capital FM, 30 November 2022

Kenyans will only need to dial *254#, to access the Hustlers' Fund starting Thursday, following its official launch by President William Ruto Read more »

-

Kenya: Hustlers' Fund - Frequently Asked Questions

Capital FM, 30 November 2022

With President William Ruto set to launch the Hustlers Fund Wednesday, there are many questions on Kenyans minds ranging from access to the repayment of various loans extended. Read more »

-

Kenya: DP Gachagua Castigates Those Opposed to Hustler Fund

Capital FM, 3 December 2022

Deputy President Rigathi Gachagua has castigated those opposed to the Hustler Fund on the claims that it's offering meagre loans to lenders. Read more »

-

Kenya: Kenyans to Access Loans of Up to Sh50,000 Through the Hustler Fund

Capital FM, 16 November 2022

Kenyans will be able to access loans of between Sh500-Sh50,000 through the hustler fund at an interest of 8 per cent per year. Read more »

800,000 Loan Defaulters In Kenya's Small Business Hustler Fund

President William Ruto has said that 800,000 Hustler Fund loan borrowers have defaulted on their repayments, Njoki Kihiu reports for Capital FM. The president is urging borrowers to make payments on time, so that they can increase their loan limit and savings.

Over eight million Kenyans registered for the fund since its launch on November 30, 2022.

The Hustler Fund is President William Ruto's pet initiative, which he promised during his presidential campaign.

Ruto insists the fund would alleviate the living standards of many Kenyans, especially those operating micro-small enterprises.

The repayment period of the loans whose annual interest rate is 8% is capped at fourteen days and borrowers who pay on time are assured of a higher credit score.

The fund also requires borrowers to set up a savings account, with 5% of the loan amount automatically going into a personal savings scheme, to which the government will contribute a maximum of 6,000 shillings per year.

To be eligible for the fund, one must be a Kenyan citizen aged 18 years and above, with a valid Identification card and a registered mobile number with mobile network providers like Safaricom, Airtel, and Telkom.

The fund offers four different products - start-up loans, micro-loans, SME loans, and personal loans.

Deputy President Rigathi Gachagua has castigated those opposed to the Hustler Fund on the claims that it offers meagre loans to lenders.

InFocus

-

President William Ruto said he was keen on confronting hunger and insecurity and turn Kenya into an equal-opportunity country for all. Among the changes the presi Read more »

-

Kenyan President William Ruto has held talks with Uganda's President Yoweri Museveni. The meeting comes within days of Museveni's son Lieutenant-General Muhoozi Kainerugaba's Read more »

-

The government has lifted the ban on genetically modified crops following a Cabinet meeting chaired by President William Ruto. The ban on genetically modified imp Read more »

-

President William Ruto has named seven women to his 22-member Cabinet, which is far short o Read more »

-

President William Ruto made his inaugural address at the 77th United Nations General Assembly (UNGA) in New York, United States on Wednesday September 21, 2022. H Read more »