-

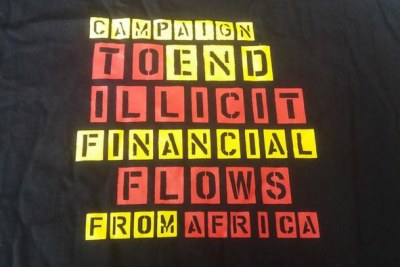

Africa: Countries Must Work Together to Stop Cross-Border Tax Evasion

allAfrica, 21 March 2023

Tax administrations have long suspected that tax evaders hide their wealth abroad in significant quantities. Now we have proof. Read more »

-

Tanzania: Friendly Tax Collection System Pushes Revenues Up

Daily News, 20 March 2023

Pundits predict brighter future Read more »

-

Kenya: Why President William Ruto's Sh3 Trillion Tax Collection Target is Unrealistic

Capital FM, 20 March 2023

The Kenyan government targets raising Sh3 trillion for the financial year ending 2024, amid tough economic challenges caused by the Ukraine-Russia conflict as well as drought and… Read more »

-

South Africa: South Africans Endorse Taxation, Say It Is Fair to Tax the Rich At Higher Rates to Support the Poor

Afrobarometer, 17 March 2023

South Africans endorse taxation, say it is fair to tax the rich at higher rates to support the poor Read more »

-

Ethiopia: Tax Reforms Boon to Govt but Bane to Businesses

Reporter, 4 March 2023

Whoever is in charge of the Ethiopian economy will have to work under strict budgetary constraints. In most years, the budget deficit amounts to less than two percent of the GDP.… Read more »

Countries Must Work Together to Stop Cross-Border Tax Evasion

In 2021 alone, information on assets of nearly EUR 11 trillion held outside the taxpayers' place of residence was exchanged through the Standard for Automatic Exchange of Financial Account Information .

Since 2013, tax administrations collected over EUR 114 billion in tax, interest and penalties through voluntary disclosure programmes and other tax compliance initiatives.

Information exchanged on the Standard helps tax authorities track income so that it can be taxed and support domestic needs. It is therefore critical that African countries promote such cross border support in order to reduce tax evasion.

More African countries will be implementing this Standard in the coming years. Ghana, Mauritius, Nigeria, South Africa, Seychelles, have already implemented the Standard while Kenya, Rwanda, Tunisia and Uganda are already making advanced preparations to do so.

African countries will be deprived of much needed resources as long as we struggle to collect all taxes due to them. It is critical that we build local tax authority capacity and work together to support domestic income generation, write Thulani Shongwe and Melissa de Jong for allAfrica.

InFocus

-

The Minister of Finance, Jibril Ibrahim, recently called for expanding the 'taxes umbrella" - as he considers it "the most effective and successful way to increase tax revenues and ... Read more »

-

Tax revenues account for more than 85% of Tanzania's domestic revenues and about 70% of government expenditures, according to the Bank of Tanzania. A study done by Read more »

-

Tax simplification would level the playing field between tax authorities and multinationals by relying on easily verifiable standards, writes Tim Hirschel-Burns for African ... Read more »

-

In developing countries, and the sub-Saharan region especially, the scale of unmet basic needs is enormous. It is estimated that Read more »

-

Martina Schwikowski for Deutsche Welle reports that every year, African countries miss out on vast sums of taxpayers' money due to a lack of logisti Read more »

![[Sudan] Traders on their way to El Fasher (file photo).](https://cdn08.allafrica.com/download/pic/main/main/csiid/00131366:a7be2506304c5cf7ecd378645ba18a9a:arc180x120:w400:us1.jpg)