Access to rare earth minerals and Russia's war against Ukraine topped the agenda on French President Emmanuel Macron's historic visit to Mongolia. But the joint declaration signed during the meeting also underlines France's attempts to find an alternative uranium source for its nuclear reactors.

As it stands, France depends to a large extent on uranium sourced in West Africa. That supply chain, however, is under threat because of social and political unrest in the region.

The 18-article joint declaration, which trumpets "strengthening political, economic, commercial and defence cooperation", also notes that both countries will also cooperate in the energy sector.

Dig down into the declarion, however, and in Article 12 notes that as part of this cooperation, negotiations over investment in the "joint Zuuvch-Ovoo project" will be "accelerated" with an aim to concluding them in the autumn.

[Featured] #Energy: #Macron seeks to support #Mongolia in diversification of trade and #Decrabonisation - Joint venture between French and Mongolian #NuclearPower companies demonstrate #France's interest in #Uranium reserves, by @theophane_h | Euractiv https://t.co/RPFA134mns-- PubAffairs EU News & Debates 🇪🇺 (@PubAffairsEU) May 22, 2023

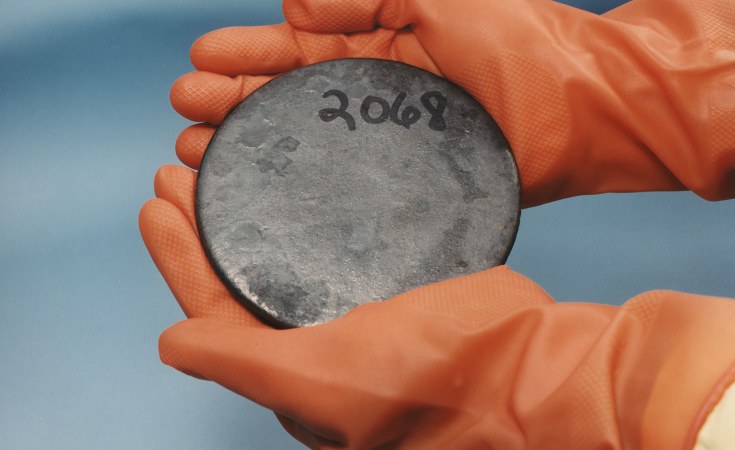

It cites, in particular, the uranium mining project run by Badrakh Energy, a company jointly run by France's Orano Group (formerly Areva) and Mongolia's Monatom.

Hasty negotiations

The relatively low position of the article addressing nuclear cooperation within the French-Mongolian joint-statement belies its importance.

France has 18 nuclear power plants with 56 reactors at the moment. That number is set to expand substantially in nthe coming years as will the need for uranium,

In response to the need to slash fossil fuel emissions and cut its reliance on foreign energy, Macron announced, in February 2022, that France would spend Ꞓ51,7 billion to build another 14 new nuclear reactors over a 28 year period.

The need for new reactors was underlined by Russia's invasion of Ukraine and the energy suppy problems that arose from it.

France's and uranium

According to figures published by the French Ministry of Ecological Transition in France, 40 percent of energy consumption comes from nuclear, 28,1 percent from petrol, 15,8 percent from natural gas, and 12,9 percent from alternative sources such as wind and hydropower.

French electricity company EDF's figures show that nuclear's part in electricity market is even higher: 70,6 percent, against hydropower's 11.2 percent, windpower 6.3 and solar 2.2 percent.

The result is that France's dependency on uranium will grow substantially in the coming years.

To satisfy its current nuclear fuel demands, France needs between 8.000 and 9.000 tons of uranium per year, according to the portal Connaissance des Énergies.

The 563 page report "Uranium 2022 Resources, Production and Demand" jointly published by the IAEA and the OECD's Nuclear Energy Agency (NEA) adds that about two thirds of the world production of uranium comes from Kazakhstan (39.4 percent), Canada (22 percent) and Australia (10 percent.) Other producers include Niger, Namibia, Russia and Uzbekistan and Mongolia.

As France does not have its own uranium deposits, it has to rely on imports.

On 23 April, French Daily Le Monde wrote that in Niger Orano's giant uranium mine faces multiple threats' including the threat of jihadist attacks.

In fact, Uranium deposits have become "a key component of France's energy independence strategy," according to the paper, but the tide is turning.

Of the two mines that were operated since 1971 in Niger, only the one in Somaïr remains. The Akouta Mining Company (Cominak) closed in March 2021 after reserves were depleted.

But the largest problem is the volatility of the region. France was forced to leave neighbouring Burkina Faso and Mali (which also provides uranium).

French troops

Orano still wants to maintain a foothold in Niger. On 4 May, the company signed a general partnership agreement with the government of Niger, which, according to Nicolas Maes, CEO of Orano Mining, confirms the major role of Niger in the global uranium industry. But the unrest on its doorstep is starting to take its toll.

For now, French troops are still present in Niger, co-patrolling the border region with the Nigèrian army under "opération Almahaou" to monitor activities in neighbouring Mali and Burkina Faso as the French forces there were wound down.

Meanwhile, in Niger itself, the Imouraren mine, presented as the "mine of the century" by Orano and snatched from the Chinese in 2009, is still "on hold pending feasibility studies of new mining techniques".

However, the real reason is more likely to be the human and investment risk, which may be too high.

According to an infograph by Orano published in 2021, France has been gradually moving away from Niger for its uranium: Most of the "yellow cake" now comes from Kazakhstan (2,840 ton), with Niger's Somaïr (1,996 ton) still a solid second. The Cigar lake mine at McLean Lake Mill in Canada also produces 1,788 tons.

However, with the increasing instability in the region, alternatives are indispensable.

The role of Mongolia

French-Mongolian cooperation on uranium is not new. Areva Mines has been involved in exploring the Dornogovi province since 1997. The World Nuclear Association says that the Zoovch Ovoo deposit has resources of over 54,000 tons of Uranium.

In 2015, nuclear cooperation between France and Mongolia took a step forward with the creation of Badrakh Energy, a joint venture that is controlled by Orano's subsidiary Areva Mongol (66 percent) while Erdenes Mongol, through its subsidiary Monatom, holds 34 percent.

Erdenes Mongol, states that total investment is to be Ꞓ1 billion over 22 years with expected income of Ꞓ5.5 billion. A flyer by Orano says that a two year pilot deal with new mining processes that was launched in 2021 will generate 20 tons of uranium.

Macron now hopes to speed up the paperwork on this so full production could start in the autumn, easing the pressure on France's increasingly hungry nuclear reactors.