I want to begin by commending your achievements, each one in your respective mandates as heads of regional economic commissions and leaders of sub-regional financial institutions.

The progress Africa has been making is in some measure a reflection of our collective efforts in our respective mandates, from peace building, entrenching governance, regional integration and financing infrastructure. The African Development Bank is honoured to be your partner.

Like the continent itself, the African Development Bank has grown significantly over the last decade. At this time our ongoing active portfolio is 25 billion dollars, sixty percent of which is infrastructure. Last year we committed around seven billion dollars of projects, sometimes in close collaboration with you in COMESA, IGAD, EAC, SADCC, ECCAS and ECOWAS. Our staff work in close touch in all our institutions.

Last time we met in Addis with Dr. Zuma and Mr. Lopes we put in place the framework for a study of the mega-trends and what they will mean for Africa in 50 years. From demographic dynamics, to technology leap-frogging, climate change, the shift in the global economic landscape and so on. That study is well advanced, for our leaders to consider at the next AU Summit.

We are here to deepen our coordination in the context of that work we are doing together on Africa in the next 50 years... to put our heads together on how we can better deliver for Africa and to look ahead, far beyond the short term considerations.

We know the challenges; we know the direction of travel. The global economy is slowing down. The big question we need to ask is whether or not in this morose environment Africa can maintain the pace of the last decade.

My own assessment is that Africa can still maintain the momentum if:

We emphasize inclusive policies, which are not only good politics but also excellent economics, as we are doing in our Ten Year Strategy;

There is greater integration;

There is faster progress on the global value chains.

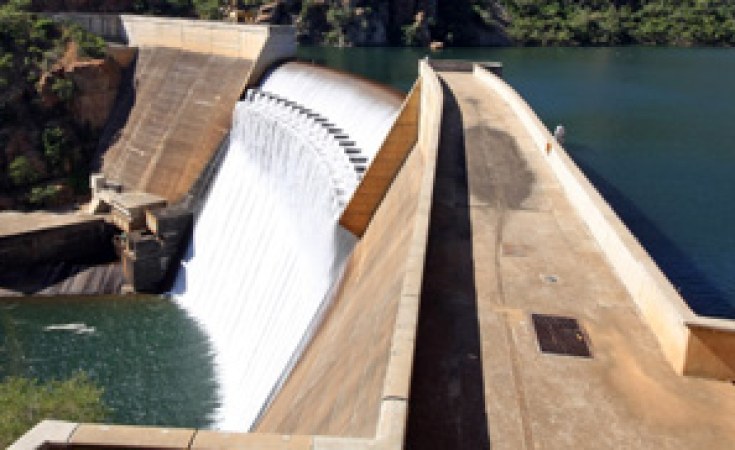

The one thing which can really slow down the recent performance in its tracks is infrastructure. No country in the world has been able to maintain 7% GPD growth and above (sustainably) unless the infrastructure bottleneck is overcome.

We are today, all sources combined, hardly able to put together 45 billion dollars a year, leaving an annual gap of similar volume. We are all doing different things in our respective regions with new initiatives and funds being created, but let us face it: there is limited additionality and no critical mass.

We have not come to a dead end, but we are at fork in the road. The ongoing initiatives will not bring us to scale. Business as usual will not finance our infrastructure. Our governments are doing more as they raise more revenues, including from natural resources rent. This is encouraging; many projects will still require public money; that is why greater efforts at mobilizing domestic resources are key.

Development partners will continue to be needed. But the tight financial situation they face is real.

Accessing capital markets, as many countries are doing, is commendable. More countries should get out there and get ratings, provided we can invest wisely and manage debt.

But of course there will be limits. And with the end of quantitative easing, markets at some point will be tight.

The current natural resource boom provides an opportunity for those who have them, provided the taxes and other sources of revenues due are paid.

Taking into account PIDA, building on our track record in infrastructure, we have been reflecting on how to create a vehicle to complement existing instruments. Study after study has shown that there is a reasonable pool of savings in Africa which can help in funding our development. Those are typically invested in European or US paper. But those pools are available only if the business proposals are attractive. Those managing the funds are fiduciaries and they will part with the money under clear commercial considerations. If that is true for Africa's pool of savings it is also true for external savings such as the SWF.

As we reflected on these issues in the Bank, we concluded there are three problems:

The perennial problem of lack of ready-to-go projects;

The even larger problem of finding those that are commercially viable and bankable;

The need for a vehicle which does the necessary risk mitigation, credit enhancement, provides investors with assurance of a good return, security and, in the case of Central Banks, liquidity as well.

As you all know financing infrastructure is the core of our business. Of our current, active portfolio of 25 billion dollars, 17 billion is in infrastructure. We are probably involved in some ways in one in three of the projects you will see across Africa. We like to bring our experience to bear for the collective advancement of Africa's infrastructure agenda.

I think the AU Leaders in January will be expecting us not simply to provide scenarios about the future but also how it will be financed. That is the idea of the Africa 50 vehicle. I first mentioned this idea at the SADCC Summit in Maputo.

It will be a vehicle which can build on the AfDB track record and financial strength as investor, financial engineer, attract local and international pools of savings, utilize smart aid and leverage that to up our funding of infrastructure. It will be a strongly rated instrument able to issue a bond of significance - a bond attractive to investors.

Two things are key here: the projects we would target would be commercially viable, transformational and identified as priority in our respective regions; and the financial engineering involved is complex but doable.

The matter was considered by our Finance Ministers and endorsed in Marrakesh.

I will be in Mauritius later in August to speak to Central Bank Governors. We are talking to outside partners. A number of countries and institutions have declared support. We would like to share with you where we are today and seek your support so that together we can pilot this as a fully owned African initiative.

I would like to point out for reference that our colleagues in the Asian Development Bank and ASEAN have just rolled out almost a similar vehicle. I visited Manila last October at the HQ of the Asian Development Bank and I can see potential for peer learning. We have no choice Africa 50 is possible and is necessary.

The African Development Bank, given its experience and mandate, will play a lead role but this is our collective instrument.

Thank you.