-

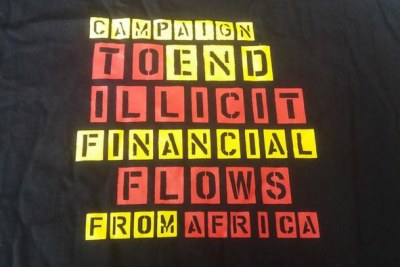

Africa: Africa Presses for UN Tax Plan Despite EU Resistance

International Consortium of Investigative Journalists, 26 October 2023

The United Nations is on the cusp of negotiating an international tax convention to tackle inequality and tax abuse, but transparency advocates say some wealthy countries are… Read more »

-

Africa: Tax Havens Could Cost Countries $4.7 Trillion Over the Next Decade, Advocacy Group Warns

International Consortium of Investigative Journalists, 11 August 2023

The U.K. continues to lead the so-called “axis of tax avoidance,” which drains an estimated $151 billion from global coffers through corporate profit-shifting, a new… Read more »

-

Africa: Developing Nations to Get More Tax Revenue From Multinationals - But Is It Enough?

allAfrica, 12 October 2021

The world's developed nations have taken a step towards reforming international taxation rules to give developing nations a fairer share of the taxes paid by large multinational… Read more »

-

Africa: How Multinationals Avoid Paying Their Taxes

allAfrica, 16 January 2019

Two pioneering studies which expose in new detail how multinational corporations avoid paying tax in a developing nation are likely to intensify pressure on the largest firms… Read more »

Nigeria Leads African Bid to End Corporate Tax Dodging

It has been estimated that multinational corporations from the world's wealthiest economies avoid paying taxes on around one-third of their profits from other nations, totalling $1 trillion a year.

In 2021, the Organisation for Economic Co-operation and Development (OECD), whose member countries include most of the world's developed countries, announced an agreement with nearly 140 countries aimed at giving developing nations a fairer share of tax revenue.

But its implementation has been beset by delays and a pillar of the deal meant to force American tech giants and others to share profits with the countries where they operate looks set to fail, reports Joanna Robin for the International Consortium of Investigative Journalists.

With many lower-income countries questioning whether a grouping of the world's richest countries should shape the global tax regime, Nigeria has introduced a draft resolution at the United Nations on behalf of African nations, calling for a legally-binding UN tax convention.

Documents

-

11 October 2023

Promotion of inclusive and effective international tax cooperation at the United Nations

- Publisher:

- United Natons General Assembly

- Publication Date:

A draft resolution, filed at the United Nations by Nigeria on behalf of African member states, which calls for a legally-binding UN tax convention. see more »

InFocus

-

In 2021 alone, information on assets of nearly EUR 11 trillion held outside the taxpayers' place of residence was exchanged through the Standard for Automatic Exchange of Fin Read more »

-

Martina Schwikowski for Deutsche Welle reports that every year, African countries miss out on vast sums of taxpayers' money due to a lack of logisti Read more »

-

Tax simplification would level the playing field between tax authorities and multinationals by relying on easily verifiable standards, writes Tim Hirschel-Burns for African ... Read more »

-

In developing countries, and the sub-Saharan region especially, the scale of unmet basic needs is enormous. It is estimated that Read more »

-

A new agreement between 136 nations addresses the way in which multinationals transfer profits earned in one country and shift them to a "tax haven" - a country with a lower tax ... Read more »